Claiming Gambling Losses On Taxes

- Claiming Gambling Losses On Federal Taxes

- Claiming Gambling Losses On Taxes

- Claiming Gambling Losses On Your Taxes

- Gambling Losses 2019

- Claiming Gambling Losses On Taxes 2018

We have talked about poker players and taxes before. However, questions remain for many players. So, USPoker.com recently spoke with Nathan Rigley, lead tax research analyst with H&R Block.

How to Claim Gambling Losses on Your Income Taxes. Maybe that big weekend in Vegas didn't turn out like you had hoped. Perhaps you like to play the ponies on a routine basis. It doesn't matter what particular game you prefer, if you lose more often than you win over the course of the year, you might be able to claim those losses on your income. Claim your gambling losses on Schedule A, Itemized Deductions, under ‘Other Miscellaneous Deductions’. The IRS recommends that you keep a written documentation, like a notebook or a diary, for proof in case of an audit and to keep winnings and losses separate and organized.

- Can I claim gambling losses for fantasy sports? The general rule for claiming gambling losses is that you can never deduct more for losses than you report for income. So, if you win $1,000 and lose $1,500 in another league, your deduction is limited to just $1,000. You can’t deduct your losses without reporting your wins.

- They qualify for a $24,000 standard deduction. They had $15,000 in deductions for home mortgage interest and property taxes, $1,000 for charitable contributions, and their $4,000 gambling loss. This comes to a total of $20,000 in personal deductions. Since this is less than their $24,000 standard deduction, they should not itemize.

- Claiming big gambling losses or not reporting gambling winnings. If you’re a recreational gambler you must report your winnings as “other income” on the front page of your 1040 form. If you’re a professional gambler you will need to report your winnings on Schedule C.

His words rang true as advice for every poker player. Whether you’re a reg at a local card club, a top touring pro or someone in between, you need to consider your tax obligations when you play poker.

All winnings are taxable

First and foremost, all gambling winnings are taxable — no matter the amount.

“Just because a taxpayer doesn’t receive a tax form does not make the winnings tax-free,” Rigley said. “Taxpayers still have a responsibility to report their prize on their tax return as ‘other income.’”

Those winning a larger amount at a casino are likely to receive a tax form, and the IRS will also receive that form. Not reporting it can have some ugly consequences, including:

- Audits

- Penalties

- Interest

Don’t leave anything to chance and don’t try to conceal. Report those winnings to avoid a lengthy, and uncomfortable, visit with the IRS.

Keeping records helps in the long run

The IRS recommends gamblers keep an accurate diary or records to substantiate wins and losses on a tax return. For poker players, that includes sessions at the tables, buy-ins and amount won or lost.

You read that correctly; record losses because you can be deduct them against winnings. Winners can deduct losses, but only as much as the amount won.

For example, a player who wins $200,000 in a big Sunday tournament online must report those winnings to the IRS. Let’s say that, in the same year, that same player lost $32,000 worth of tournament buy-ins, but profited $9,000 at cash games.

Altogether, this player will have total taxable winnings of $177,000 ($200,000-$32,000+$9,000). So, losses can help players send less of their cash to the US Treasury.

Planning is important

When it comes to tracking wins and losses, here’s what Rigley recommends to include in gambling records:

- Date and amount wagered, including tournament buy-ins

- Name and location of betting or tournament

- Amount won or lost

Obviously, online poker makes this task easier. Players can review buy-ins and wins and losses easily.

However, don’t merely rely on the poker software to keep your records. It is beneficial to review often and keep track independently.

Bettors should also keep verifiable documentation of losses and expenses including:

- Buy-in tickets

- Canceled checks

- Credit card records

As a Boy Scout, when it comes to taxes, be prepared.

Remembering expenses

This year, tax filers have some new rules. For poker players, the Tax Cuts and Jobs Act changed many aspects related to itemized deductions.

That includes the elimination of miscellaneous deductions that were subject to a 2% floor of adjusted gross income.

“This has been impactful for many taxpayers,” Rigley said. “Luckily, the deduction for gambling losses, though a miscellaneous deduction, was not subject to this floor.”

So, poker players can continue to claim gambling losses as an itemized deduction toward their gambling income. However, it is important to stay abreast of any changes to the tax code each year.

Are there differences in sports betting, poker, and other gambling?

To the IRS, there generally is no difference in various forms of gambling. The only difference may be if a taxpayer treats gambling as a sole means of earning a living.

Bear in mind, however, that the IRS is not a law enforcement agency. Even those who wager where it may not be legal are still expected to report winnings in their tax returns.

Claiming Gambling Losses On Federal Taxes

“Income from illegal gambling is treated exactly the same as those who participate in legal gambling,” Rigley says. “Gambling doesn’t make the winnings tax-free. Taxpayers who make illegal wagers and win still need to report the income on their tax return. If the taxpayer itemizes deductions, they can still deduct the loss to the extent of gain.”

Pros should treat poker as a business

Full-time players or those who view the game as more of a career have some different benefits and requirements. For instance, a pro player may be able to file as a business with a Schedule C form.

These players can also deduct expenses like a business or someone who works for himself. So, things like travel expenses, meals when at tournaments, and other business-related expenses may qualify as deductible for tax purposes.

However, filing as a business also has some additional requirements. Notably, players are potentially subject to self-employment tax and possible quarterly estimated payments. So, keeping good records and receipts is important.

There’s one additional requirement under the new tax reform. Players can no longer deduct non-wagering business expenses in excess of net wagering income. That keeps players from claiming a loss.

Save a chunk for the IRS

Players who score big in an event are advised to set a big piece of that cash aside for future taxes.

“We always suggest that the first check they should write is the IRS for an estimated payment on the taxes they will owe on those winnings,” Rigley says. “This is essentially a deposit toward your tax liability.

“The reason we suggest this is that it helps to avoid any underpayment penalties for failing to deposit enough taxes throughout the year, and psychologically it seems easier to write that check when the income is new rather than be hit with the balance due down the road when the return is filed.”

A player may also want to consider investment vehicles such as a Roth IRA or other options to lower their tax burden. An IRA also helps players plan for retirement and possible lean times.

Filing your taxes and writing a check to the IRS is never fun. However, making a concerted effort throughout the year can help take the sting out of the process.

Claiming Gambling Losses On Taxes

Gamblers understand the concept of win some, lose some. But the IRS? It prefers exact numbers. Specifically, your tax return should reflect your total year’s gambling winnings – from the big blackjack score to the smaller fantasy football payout. That’s because you’re required to report each stroke of luck as taxable income — big or small, buddy or casino.

If you itemize your deductions, you can offset your winnings by writing off your gambling losses.

It may sound complicated, but TaxAct will walk you through the entire process, start to finish. That way, you leave nothing on the table.

How much can I deduct in gambling losses?

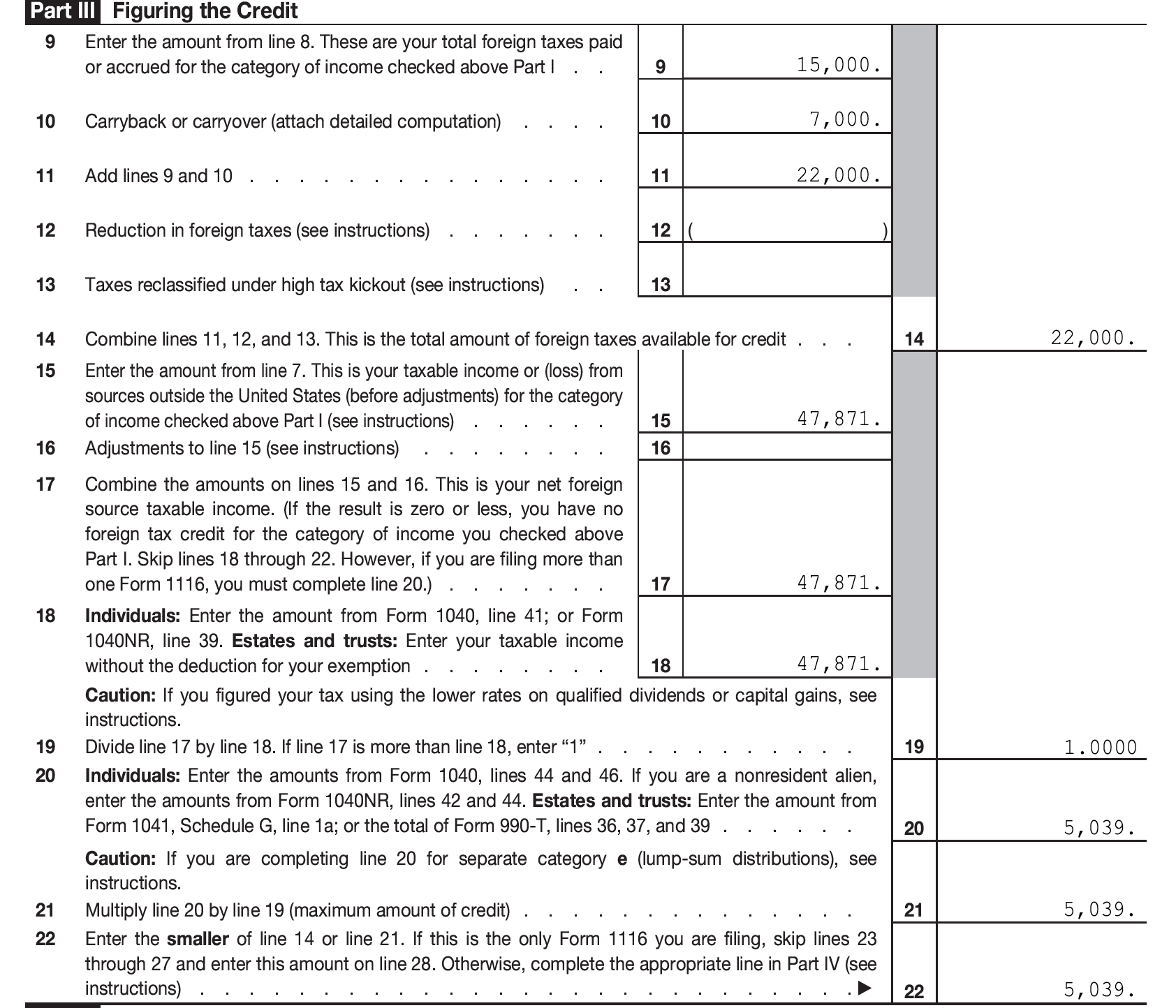

You can report as much as you lost in 2019 , but you cannot deduct more than you won. And you can only do this if you’re itemizing your deductions. If you’re taking the standard deduction, you aren’t eligible to deduct your gambling losses on your tax return, but you are still required to report all of your winnings.

Where do I file this on my tax forms?

Let’s say you took two trips to Vegas this year. In Trip A, you won $6,000 in poker. In the Trip B, you lost $8,000. You must list each individually, with the winnings noted on your return as taxable income and the loss as an itemized deduction in Schedule A. In this instance, you won’t owe tax on your winnings because your total loss is greater than your total win by $2,000. However, you do not get to deduct that net $2,000 loss, only the first $6,000.

Now, let’s flip those numbers. Say in Trip A, you won $8,000 in poker. In Trip B, you lost $6,000. You’ll report the $8,000 win on your return, the $6,000 loss deduction on Schedule A, and still owe taxes on the remaining $2,000 of your winnings.

What’s a W-2G? And should I have one?

A W-2G is an official withholding document; it’s typically issued by a casino or other professional gaming organization. You may receive a W-2G onsite when your payout is issued. Or, you may receive one in the mail after the fact. Gaming centers must issue W-2Gs by January 31. When they send yours, they also shoot a copy to the IRS, so don’t roll the dice: report those winnings as taxable income.

Don’t expect to get a W-2G for the $6 you won playing the Judge Judy slot machine. Withholding documents are triggered by amount of win and type of game played.

Expect to receive a W-2G tax form if you won:

- $1,200 or more on slots or bingo

- $1,500 or more on keno

- $5,000 or more in poker

- $600 or more on other games, but only if the payout is at least 300 times your wager

Tip: Withholding only applies to your net winnings, which is your payout minus your initial wager.

Claiming Gambling Losses On Your Taxes

What kinds of records should I keep?

Keep a journal with lists, including: each place you’ve gambled; the day and time; who was with you; and how much you bet, won, and lost. You should also keep receipts, payout slips, wagering tickets, bank withdrawal records, and statements of actual winnings. You may also write off travel expenses associated with loss, so hang on to airfare receipts.

Gambling Losses 2019

Use TaxAct to file your gambling wins and losses. We’ll help you find every advantage you’re owed – guaranteed.