Gambling Tax Uk Winnings

If you live in the United Kingdom and enjoy gambling, then you’ve probably wondered at some point if you should be paying taxes to make sure that you are on the legal side of things.

Here we will look at that aspect of tax on gambling winnings. History Of Gambling Tax In The UK. It wasn’t always so rosy for UK punters though. From 1960 through 2001, when Gordon Brown abolished gambling tax in that year’s budget, bettors could choose to pay 9% tax on either the stake (keeping it minimal) or their winnings (potentially. The UK does not tax gambling winnings. In fact, even British gamblers who play abroad won’t need to worry as the UK has treaties with other countries, so you won’t be affected by their tax. List of information about Gambling duties. Help us improve GOV.UK. To help us improve GOV.UK, we’d like to know more about your visit today. Prior to the new tax reform law, taxpayers’ costs (like transportation and admission fees) could be claimed regardless of winnings. But beginning with the tax year 2018 (the taxes filed in 2019), all expenses in connection with gambling, not just gambling losses, are limited to gambling winnings.

Gambling Tax Uk Winnings Tax Calculator

Whether we’re talking about lottery winning taxes, casino winnings taxes for slots, table games or even live casino, you need to know what the legal procedures are so that you never get negatively surprised by anything.

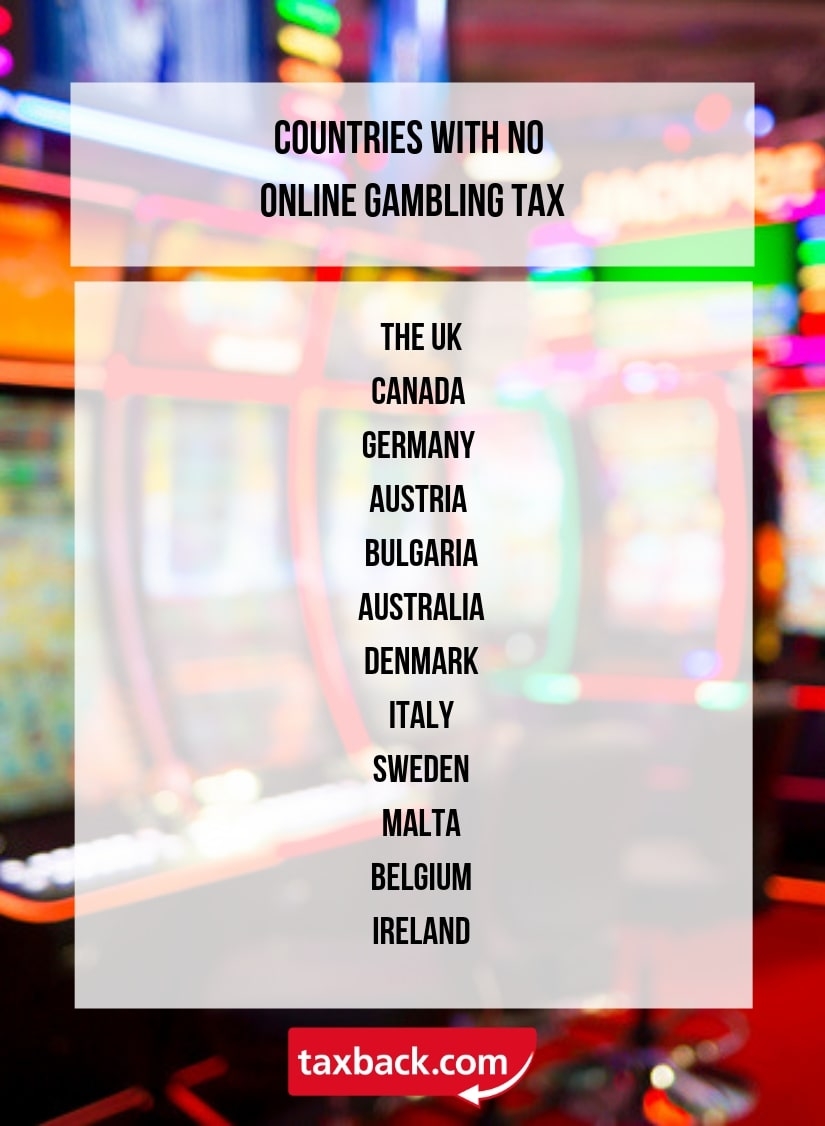

So how much money can you win from gambling without paying taxes in the UK? The short answer? All of it. Gambling winnings aren’t taxable in the UK. While other countries will tax anywhere between 1% and 25%, the UK won’t care if you’ve won £10 or £10.000.000. No matter what kind of gambling you’re doing from bingo to horse racing and everything in between, there will be no gambling winning tax in the UK.

Even if you’re a UK citizen and want to gamble abroad, most times you shouldn’t worry about taxes because the UK has treaties with most countries, so you won’t be affected by their tax requirements.

Gambling Tax Uk Winnings Money

Gambling wasn’t always free in the UK and the gambling history is quite complicated. Betting first started being regulated in 1960 but there was a 9% tax. It was abolished in 2001 and replaced with a 15% tax on bookmakers, but if the bookmaker wasn’t based in the UK they didn’t have to pay it which meant losing revenue to offshore sites.

The amendment to the 2005 Gambling Act in 2014 chanced things so that the 15% tax was on all gross profits at the point of consumption to include offshore companies as well. This meant that operating in the UK without a UK licence would be illegal. The thing is that the tax is paid by operators, so bettors don’t need to worry about it.

There are taxes related to gambling that will affect you if you live in the UK. Bigger wins can be subject to income tax that’s 18% and there’s also an inheritance tax when you die. The threshold for this one is £325.000 and everything bigger than that will be subject to a 40% tax. Even gifts are subject to tax and you can give up £3000 each year tax-free to any one person, but if you die within 7 years they will be taxed on it.

All in all, there is no tax on gambling, and you might want to look for non gamstop casinos, but there are different taxes you should take into account. The best thing to do if you end up winning big is to look for a financial advisor to help protect your money.